Cition

Cognitive Cities

What is Cition?

Cition is an Australian owned and operated developer specialising in major Cognitive City projects. It was established to create and deliver world-class Cognitive Cities in Australia and globally. See our world’s first cognitive city design at Australian Education City since 2014.

What is a Cition Cognitive City?

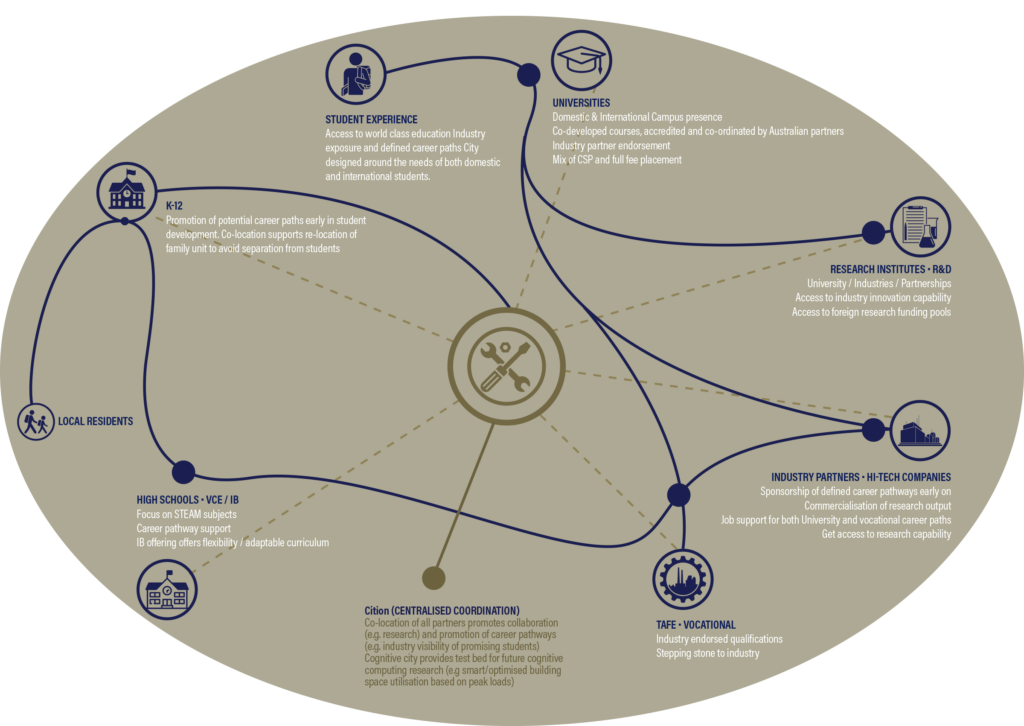

A Cition Cognitive City typically includes a mix of an Innovation District and a Learning City within walking distance from its surrounding Residential Community.

- A Learning City:

A Cition Cognitive City includes collaborative campuses with participating universities, TAFEs, high schools and primary schools, it also provides lifelong learning and remote learning opportunities to its residents. - An Innovation District:

As the term initially defined by the Brookings Institution, Innovation Districts attract local & global R&D and industry partners to work together, focused on clean energy, digital seamlessness, and with social interactions ‘fuelled by caffeine’. - A Residential Community:

The Cition Cognitive City residential community will be a 20-minute neighbourhood with urban cognitive services as opt-in offers that meet residents’ needs. It also provides world class residential living, student accommodation, age care and social housing.”

A Typical Cition Cognitive City

Cition is a pioneer in the development of Cognitive Cities.

Other Notable Innovation Districts that may help grasp our innovative proposition:

- South Boston Waterfront

- Cortex District St. Louis

- Seattle South Lake Union Area

- North Carolina’s Research Triangle

- Glasgow West End

- Knowledge Quarter London

- Knowledge Quarter Liverpool

- Manchester Oxford Road